How will mining manage amid growing demand, geopolitical tensions, and a sustainability shift? And what role does stainless steel play?

As the world faces the urgent need to achieve climate targets, the green transition is stalling. Economic and political instability are diverting attention and resources away from climate action, and we’re currently on track to miss the targets set by the Paris Agreement, according to UN Climate Change. The headwinds of today are a setback – but there’s still a path forward for the green transition.

The mining sector, historically seen as polluting and resistant to change, is now in a crucial position in this transformation. The blueprint for the green transition inevitably calls for metals and minerals to help build a more sustainable future – and companies ready for the challenge are poised to lead the industry.

To understand how the industry will transform next – and how stainless steel supports this shift – we need to first consider the challenges and pressures of today’s market.

Understanding the growing demand

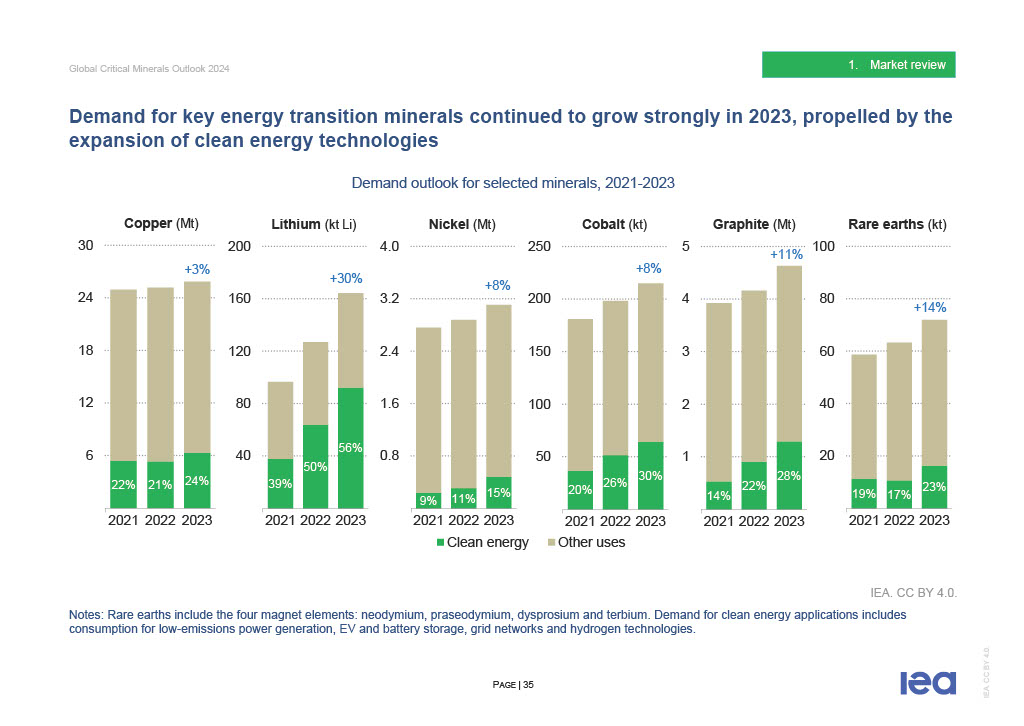

Metals like lithium, cobalt, and nickel are essential for green technologies and electrification of our society, and the increasing demand for these resources is reshaping the mining landscape.

With the rise of electric vehicles and renewable energy technologies in particular, the demand for lithium and cobalt has surged dramatically. These metals are crucial components in batteries, which power everything from smartphones to electric cars.

Copper, too, plays a significant role, particularly in the electrical infrastructure required for renewable energy systems. Every single electric engine, and the transportation of that electricity, needs copper.* In fact, renewable energy uses as much as 12 times more copper than fossil fuel energy generation.

Chart: growth of the price of copper (USD per ton) from 2016 to 2025.**

Chart: growth of the price of copper (USD per ton) from 2016 to 2025.**

As outlined by the International Energy Agency, clean energy technologies in particular form a significant part of the continued growing demand of these minerals.

However, this increased demand brings challenges. Mining companies must expand existing projects and develop new ones to meet the growing need. This expansion requires substantial investment in technology and infrastructure, often in areas with complex logistical hurdles.

The industry shift for the future

Expanding mining operations to support the green transition is no small feat. Technical complexities, environmental considerations, and community impacts must all be managed carefully.

These challenges include navigating regulatory frameworks, ensuring sustainable practices, addressing logistical hurdles in remote locations, and securing adequate financing. The need for new technology and infrastructure adds another layer of complexity. Companies must also balance short-term pressures with long-term sustainability goals as they develop and expand mining projects.

As the global focus on sustainability intensifies, mining industry players will also need to integrate sustainability topics as crucial elements of their business strategies. This shift is not merely a matter of corporate social responsibility; it is becoming a fundamental requirement for operational legitimacy and success in an increasingly eco-conscious market. That’s one of the reasons why Outokumpu’s Kemi mine, the only chromium mine in the EU, is on track to be the world’s first carbon-neutral mine this year.

There are also the added challenges from current geopolitical trends, including a renewed focus on protectionism and security of supply chains. Many of the valuable metals crucial for the green transition are predominantly mined in regions like China, Australia, and the Democratic Republic of Congo. This geographical concentration has led to increased concerns among western countries and the EU regarding the security, stability and sustainability of their supply chains. As geopolitical tensions rise and protectionist policies gain traction, nations are re-evaluating their reliance on non-domestic sources. To mitigate these risks, efforts are underway to diversify the supply chains, increase domestic production, and form strategic alliances.

In the EU the Critical Raw Materials Act aims to reduce reliance on non-European suppliers, increase new mining projects in the EU, and driving circularity and recycling initiatives. Meanwhile in the USA, politicians have introduced the Critical Minerals Security Act – bipartisan legislation which aims to examine how the country can divest from foreign operations and develop clean mining technologies.

These changes are reaffirmed by perspectives from industry experts like Martti Sassi, Outokumpu’s President Business Area Ferrochrome, who outlined why Finnish mineral production is critical to the security of the whole of Europe.

Unlocking the power of stainless steel

In my many years of working with the mining industry, it’s become clear that no matter the metal and no matter the mine, the focus is on finding solutions and tools that work, regardless of what they are made from. However, with the challenges that are on the horizon, the mining industry stands to gain much using stainless steel.

Stainless steels are durable, versatile, and highly resistant to corrosion, even in the harsh mining environment. Duplex stainless steels, which were invented at our site in Avesta almost 100 years ago, have a long track record of success – so we have an excellent understanding of their advantages in difficult conditions.

While the initial costs of stainless steel process equipment in the mining industry may be higher compared to alternatives like coated carbon steel or fiber-reinforced plastics, the true value lies in its durability and lifetime value. When the right stainless alloy is chosen, the reduced need for maintenance and repairs makes stainless steel an undeniably superior investment, keeping operations running flawlessly.

For example, the right grade of stainless steel can withstand the risks of corrosion that come from the sulfuric acid used in the leaching process. However, it’s important to clearly understand the temperature and composition of the acid, especially its chloride and metal ion content, to make sure the right grade of stainless steel is used for the job. That’s why we at Outokumpu have worked with research partners to develop corrosion diagrams specifically to help with grade selection.

The high strength of Duplex stainless steels also enables considerable material weight savings over austenitic types 304L and 316L or coated carbon steels, often used with process equipment like atmospheric leaching tanks and pressurized autoclaves. Typical process temperatures in the hydrometallurgy – which can reach an atmospheric temperature of up to 250°C during autoclave leaching – are well suited for duplex grades.

Additionally, this steel family has excellent resistance against chloride-induced stress corrosion cracking. Duplex alloys like Forta LDX2101®, Forta EDX2304 and Forta LDX 2404® can provide both technically and economically improved solutions for the industry.

Beyond the typical operational advantages, stainless steel as a material fits perfectly into the circular economy. Process equipment constructed using stainless steels is fully recyclable and has high value after the decommissioning stage of the mining complex, unlike other materials. Stainless steel producers like us really value scrap stainless steel as a raw material; our stainless steel has a recycled content rate of over 90% on average, which is a key driver in reducing emissions and promoting the circular economy.

You can learn more on how we support the mining and minerals processing industry here.

The mining industry is just one of the many areas facing rapid changes in the push towards the green transition. Learn more on how stainless steel plays a crucial role across industries and applications in this journey in our Green Transition Blueprint series.

*Source: https://internationalcopper.org/resource/on-copper-demand/

**Source: Copper prices from the London Metal Exchange.

***Source: International Energy Agency, Global Critical Minerals Outlook 2024, https://iea.blob.core.windows.net/assets/ee01701d-1d5c-4ba8-9df6-abeeac9de99a/GlobalCriticalMineralsOutlook2024.pdf